CHIPOTLE MEXICAN GRILL (CMG)·Q4 2025 Earnings Summary

Chipotle Beats EPS But Stock Tanks 8% as Traffic Declines Persist

February 3, 2026 · by Fintool AI Agent

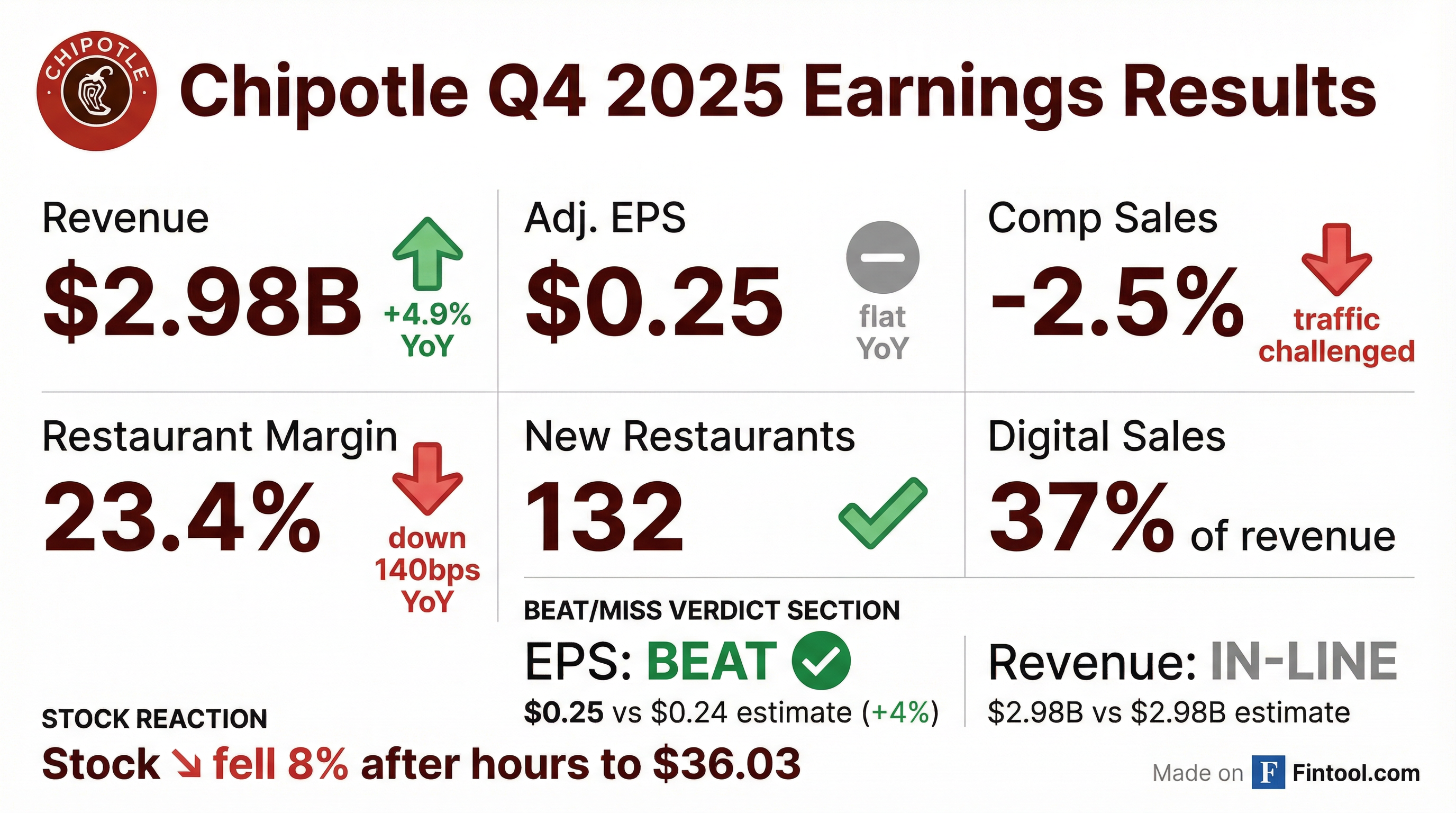

Chipotle delivered a modest Q4 2025 EPS beat but investors fled the stock after hours, sending shares down 8% to $36.03 as traffic declines persisted and restaurant-level margins compressed 140 basis points year-over-year. While the company opened a record 345 new restaurants globally in 2025 and announced an ambitious "Recipe for Growth" strategy, the market appears unconvinced that management can reverse the negative comparable sales trend that has plagued the fast-casual giant throughout the year.

Did Chipotle Beat Earnings?

Chipotle delivered mixed results that technically beat Wall Street expectations but failed to inspire confidence:

The EPS beat was driven by lower-than-expected G&A expenses ($160M vs $191M in Q4 2024) and a slightly better tax rate (23.7% vs 24.4%), rather than operational outperformance. Revenue growth of 4.9% was entirely driven by new unit expansion and gift card breakage revenue ($27M), while the underlying business saw traffic decline 3.2%.

What Drove the Negative Comparable Sales?

The -2.5% comparable restaurant sales decline in Q4 reflected transactions falling 3.2%, partially offset by a 0.7% increase in average check. This marked the fourth consecutive quarter of negative or near-zero comps:

For the full year, comparable sales declined 1.7%, with transactions down 2.9% and average check up 1.2%. Digital sales represented 37% of total food and beverage revenue in Q4, slightly higher than the full-year average of 36.7%.

CEO Scott Boatwright acknowledged the "dynamic consumer backdrop" but expressed confidence that the new strategic initiatives would drive a transaction recovery: "Through our proven business model, prudent investments in operational excellence and the support of a strong balance sheet, 2025 was a year of progress and resilience for Chipotle."

What Happened to Restaurant Margins?

Restaurant-level operating margin contracted to 23.4% in Q4, down 140 basis points from 24.8% in Q4 2024. The margin compression was driven by:

Food costs improved slightly due to menu price increases, lower dairy costs, and cost efficiencies, though beef and chicken inflation along with tariffs created headwinds. Labor costs increased primarily due to lower sales volumes creating deleveraging and wage inflation.

For the full year, restaurant-level operating margin was 25.4%, down 130 basis points from 26.7% in 2024.

What Did Management Guide for 2026?

Chipotle provided 2026 guidance that suggests stabilization but not yet a return to growth:

The Q1 comp guidance of -1% to -2% includes approximately 100 basis points of headwind from the multi-state winter storm (Storm Fern), suggesting an underlying trend of flat to -1%. Notably, this guidance does not include upside from Chicken Al Pastor launching February 10 or continued momentum from the protein menu campaign.

The "about flat" full-year comp guidance represents an improvement from 2025's -1.7% but falls short of the positive comps that drove Chipotle's premium valuation historically. Management emphasized that margins will be under pressure in the first half due to the intentional pricing/inflation gap, with the widest margin headwind in Q1 (~250bps from dislocation alone) narrowing throughout the year.

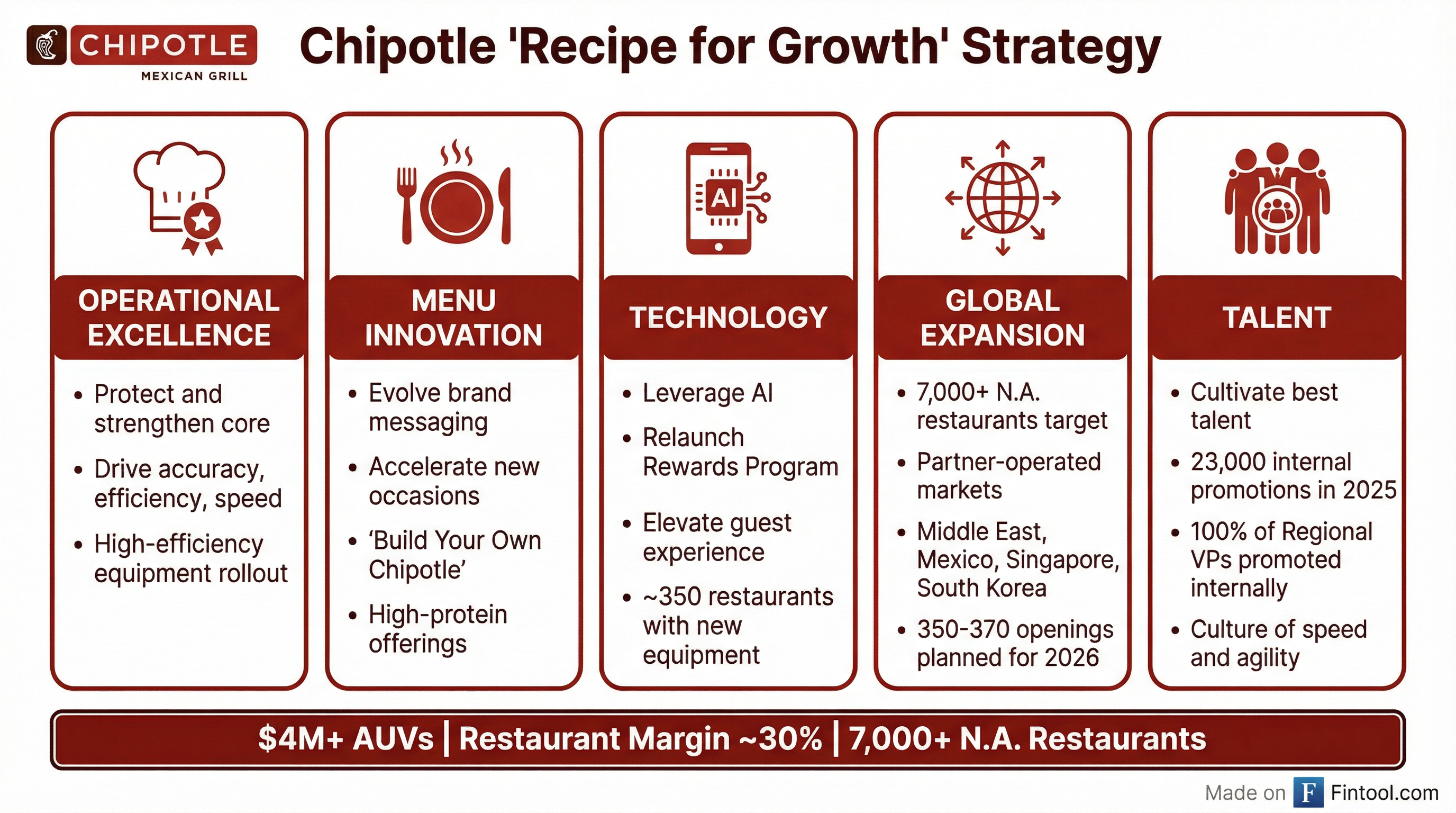

What Is the "Recipe for Growth" Strategy?

Chipotle unveiled a five-pillar strategic framework designed to "position us for success in any environment":

Key Initiatives Already Showing Results:

-

High-Efficiency Equipment Package: 350 restaurants have the new equipment today, with ~2,000 targeted by year-end. These locations are seeing higher guest satisfaction scores and "meaningful comp sales outperformance."

-

Menu Innovation: "Build Your Own Chipotle" and expanded catering are driving incremental occasions. The "Double Protein" promotion drove the highest digital sales day in company history.

-

Rewards Evolution: Loyalty comps are outpacing non-loyalty comps through increased engagement.

Long-Term Targets:

- Average Unit Volumes: $4M+ (vs current $3.1M)

- Restaurant-Level Operating Margin: Approaching 30% (vs current 25.4%)

- North America Restaurant Count: 7,000+ (vs current ~4,000)

How Strong Was Unit Growth?

Chipotle opened a record 345 new restaurants globally in 2025 (334 company-owned + 11 partner-operated), representing 9%+ unit growth:

International Expansion Accelerating:

- Middle East: 14 partner-operated restaurants, expects to "nearly double footprint and sales in 2026"

- New markets launching in 2026: Mexico, Singapore, South Korea

- Canada: 38% YoY growth, with 21 openings in Q4 alone

How Did the Stock React?

Despite the modest EPS beat, CMG shares plunged 8% in after-hours trading to $36.03, well below the $39.175 closing price.

What Spooked Investors:

- Traffic still declining: -3.2% transaction decline suggests the consumer headwind isn't abating

- Margin compression: 140bps YoY decline in restaurant margins with limited visibility on recovery

- Flat 2026 comp guidance: Falls short of the positive comps needed to justify the premium multiple

- Tariff headwinds: Management flagged 2025 tariff impacts on food costs with ongoing uncertainty

The stock has now fallen from its 52-week high of $59.19 to $36.03, a 39% drawdown. Even at this level, CMG trades at ~33x forward earnings, a premium that demands positive comparable sales growth.

Capital Allocation: Record Buybacks Continue

Chipotle returned a record $2.4 billion to shareholders via buybacks in 2025, with $742 million repurchased in Q4 alone at an average price of $34.14 per share.

The company maintains a fortress balance sheet with $1.3 billion in cash and investments and no debt, providing significant flexibility to continue returning capital while investing in growth.

What Did the Q&A Reveal?

Several key insights emerged from the analyst Q&A:

High-Efficiency Equipment Outperformance: Management disclosed that restaurants with the full high-efficiency equipment package are seeing "hundreds of basis points of improvement in comp sales," along with higher food quality and taste scores. The company has accelerated the rollout and expects to complete deployment by mid-2027.

Consumer Demographics: "60% of our core users are over $100,000 a year in average household income," said CEO Boatwright, expressing confidence in leaning into this higher-income cohort for both solo and group occasions.

Protein Menu Success: The high-protein campaign is working—extra protein incidents are up 35% since launch, and Chipotle achieved a record digital sales day with the double protein promotion. Importantly, management saw no evidence of trade-down behavior from core customers to lower-priced items.

Q1 2026 Guidance: CFO Adam Rymer provided specific Q1 guidance of -1% to -2% comps, which includes approximately 100 basis points of headwind from the multi-state winter storm. The Q1 comp range does not include any uplift from Chicken Al Pastor (launching February 10) or continued protein menu momentum.

Pricing vs. Inflation Gap: The margin pressure is intentional—pricing will be approximately 70 basis points in Q1 against inflation approaching mid-single digits (creating ~250bps of margin headwind), with pricing expected at 1-2% for the full year vs 3-4% inflation. "The pricing approach we're taking this year at 1%-2% compared to where the industry is, closer to 4%, will continue to strengthen our value proposition and give us pricing power in years to come," Boatwright explained.

Tariff Update: With recent removal of tariffs on beef and other agricultural goods, the ongoing tariff impact has been reduced to approximately 15 basis points, down from 30 basis points in Q4.

Management Transitions: The company is conducting a national search for a new Chief Marketing Officer after Chris Brandt's departure, and is also hiring a Chief Digital Officer and VP of Emerging Technologies to accelerate the technology and innovation agenda.

What to Watch Going Forward

Near-Term Catalysts:

- Chicken Al Pastor launch (Feb 10): The most requested LTO in company history returns, with 2x social media requests vs. any other menu item

- Q1 2026 comp trends: Will the -1% to -2% guidance prove conservative if initiatives gain traction?

- High-efficiency equipment rollout: 2,000 restaurants targeted by year-end, with full fleet completion expected mid-2027

- Rewards program relaunch: Spring 2026 launch designed to remove friction and target in-restaurant guests (only 20% of in-restaurant transactions use rewards vs 90% on app)

Key Risks:

- Consumer spending pressure, though 60% of core users are >$100K income

- Pricing/inflation dislocation creating ~150bps margin headwind for full year

- CMO vacancy during critical marketing year with increased spend and 4 LTOs planned

- Execution risk on international expansion, particularly in France where wage and occupancy costs remain challenging